UK steel industry's 2024 production dramatically declines

The UK steel industry experienced a significant decline in production in 2024, primarily due to a transition to electric arc steelmaking, intense competition from overseas, and high input costs. In addition, the major end-use sectors in the UK have shown mixed performance last year.

In 2024, crude steel output in the UK fell by 29% from a year earlier, totalling 4.0Mt, while in December production was only 160,000t, a drop of 63%. From January to November of 2024 overseas shipments of steel products to the UK surged by 25.8% year-on-year, reaching 6.2Mt, mainly driven by intra-group deliveries. Imports of flat steel products rose by 12.4% over the same period, while deliveries of semi-finished products jumped more substantially, following the closure of two blast furnaces in July and September. Overseas shipments of long products into the UK climbed by 11.1% in 2024.

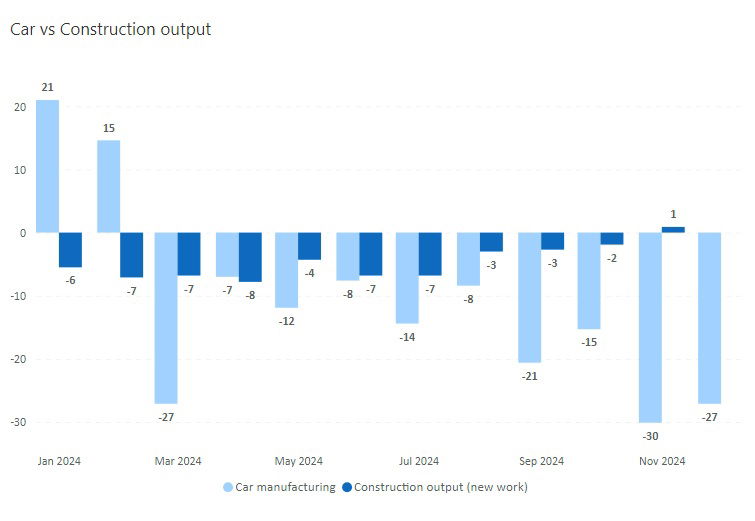

The automotive industry witnessed a drop in production amid its shift towards electric vehicles. British car manufacturing totalled 779,584 units, down 13.9% year-on-year, with an 8% decline recorded in the domestic market to 176,019 units. Overall vehicle production slipped by 11.8%, to 905,233 units over the same period. Electric vehicle manufacturing fell by 20.4%, to 275.896 units. However, car registration in the UK inched up by 2.6% in 2024 compared to the previous year, to 1.95 million units, with a substantial growth recorded in registration of electric vehicles. The construction sector faced a challenging time in the past few years due to increased costs and a decline in investments and demand amid tough economic conditions.

Construction output declined sharply in late 2023, but a slow recovery was recorded in the second half of 2024 across most sectors, apart from public housing and commercial work, according to Office for National Statistics (ONS). However, the industry experienced high number of insolvencies, totalling 4,102 in the 12 months to November 2024, according to the Insolvency Service. This was 6.3% down compared to 12 months to November 2023, but the share of construction firms was 14% of all registered businesses in the UK last year compared to 13.8% in 2023 and 13.5% in 2022.